Following his announcement of the Spring Budget, Chancellor Jeremy Hunt found himself at the centre of a heated conversation about the future costs of motoring. If you’re like most people, your car isn’t just a means of transportation but a significant part of your economic landscape too.

Whether you’re an individual eyeing your monthly fuel bills with apprehension or a business navigating a transition to electric vehicle (EV) fleets, the budget propositions likely prompted more than a passing interest.

Here, we break down what the Spring Budget of 2024 means for you in the context of EVs and fuel and how government policy might shape your motoring experience over the coming months.

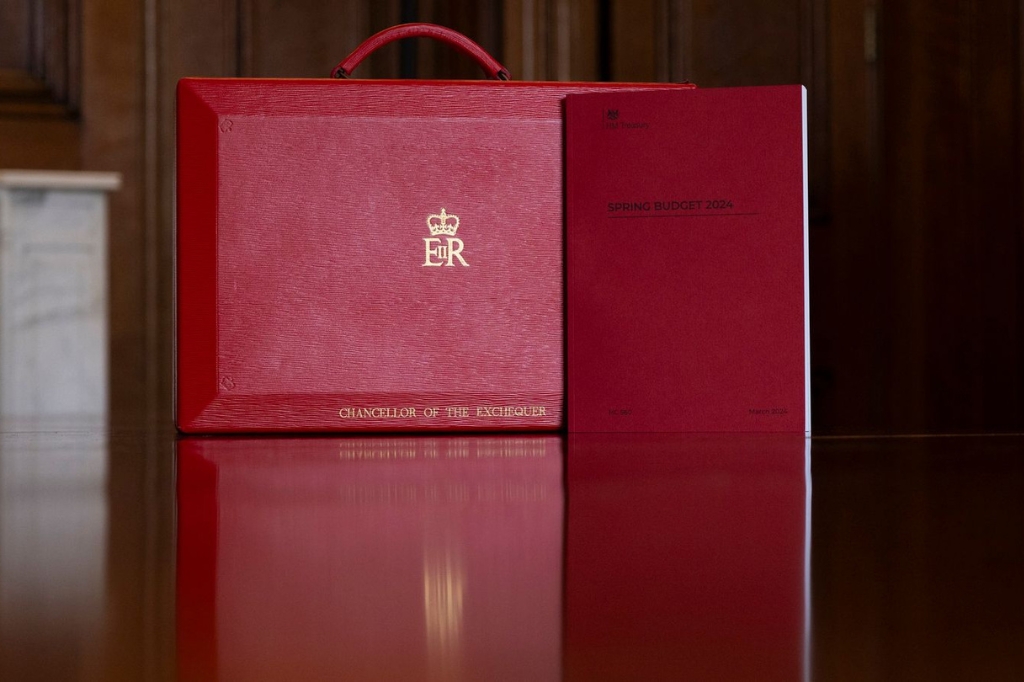

Credit: Sky News

In a move that brought relief for motorists, the budget maintains a 5p-per-litre cut on fuel duty for another 12 months. This decision has been welcomed by the logistics and fleet sectors, where lower running costs could see funds freed up for business expansion, staff onboarding, or innovation expenditure.

Critics argue that there was a missed opportunity to cut fuel duty further. Some have even suggested experimenting with a 20p cut for the next quarter.

They believe that the lost revenue from fuel duty cuts could be better utilised to support greener initiatives like public transport services or investment in advanced EV technology. If this suggestion were taken on board, it could have a significant effect on fuel and EV charging prices for the rest of 2024.

Last year, the tax breaks on businesses investing in plant and machinery, including trucks and vans, became permanent. This essentially rewarded leasing firms with up to 25p off their tax bill for every £1 they invested.

In the Spring Budget, the Chancellor announced that this funding would be extended to leasing companies. This could represent a £10bn tax cut for businesses every year to help incentivise investment.

Experts expect that this will increase flexibility and allow businesses to upgrade to cutting-edge technology, while affordability will be covered through increased investment and higher productivity.

Many have argued that the budget lacked the necessary measures to stimulate the automotive retail industry and EV market demand. Critics have pointed out an alarming absence of price incentives for private EV buyers in the UK, a factor they deem critical in preventing EV sales from stagnating.

This criticism extends to the lack of purchase incentives for family EVs, with industry insiders calling for urgent action to address this issue. The automotive sector is grappling to meet the 2024 EV share target, and there seems to be a glaring lack of government support for EV incentives, making the goal even more elusive.

To encourage the switch to EVs, suggestions have been made to equalise VAT on public and private EV charging points. This would greatly influence how the rest of 2024 will impact fuel and EV charging prices.

Despite the perceived shortcomings in the budget, there are still ways for you and your employees to access the latest EVs. Our Novalease solution offers an innovative car employee benefits solution that can help you navigate the changes in fuel and EV prices throughout 2024.

Novalease distinguishes itself by having the car lease directly with the employee, not the employer. The scheme covers fixed payments for running a vehicle (excluding fuel) and provides access to corporate discounts.

Alternatively, if you’re looking to meet your ZEV quota by transitioning to an all-electric fleet, take a look at our eStart plan. It offers an end-to-end planning solution that includes an assessment of a company’s goals, vehicle-by-vehicle review, infrastructure upgrades, and more.

If you want to find out more about our solutions, feel free to reach out to us today. Our team is always happy to help.

- The Benefits of New EV Charging Technologies

- A Look at the New EVS of 2024

- How EV Salary Sacrifice Schemes Can Power a Greener Future